Don't Let the Truth Get in the Way of a Good Story: How to Value YC Startups

Visit lobstercap.com for more.

If you want to dive deeper and learn more about the new YC F25 batch, join us at our upcoming webinar:

A lot of capital allocation in tech happens on vibes, networks, FOMO, and marketing.

This is one of the first realizations you have when you work in venture capital.

The best and most consequential science does not necessarily win. Real innovation can lose out on capital to questionable projects when it comes to raising millions.

In part, this is because VCs love to say that “storytelling is the most important founder skill.” So funding flows to charismatic charlatans. People who can spin a compelling narrative get meetings, get terms, get wires.

The counter-argument goes like this: narrative is everything. After all, startups are mostly just stories about the future. If you’ve been in venture for a few years, you start to realize the components of an idea or business or valuation are maybe 25% intrinsic qualities and 75% narrative. Maybe worse.

Both camps miss the point.

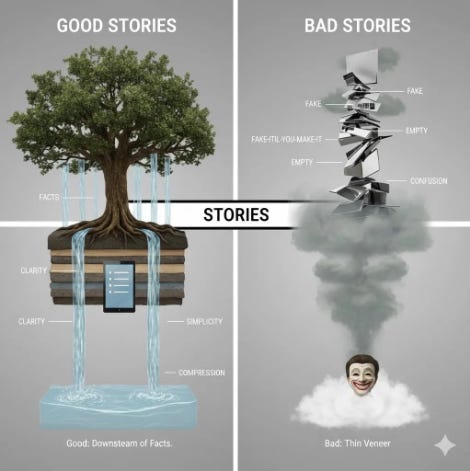

Good Stories vs. Bad Stories

Great stories are important. But they must be downstream of facts.

Good narrative is storytelling with clarity and simplicity underpinned by often complex and fact-based strategy. It’s a compression of complex ideas into something actionable.

Bad narrative is thin-veneer, smoke-and-mirrors, fake-it-til-you-make-it nonsense. It’s an expansion of weak ideas into something that sounds impressive.

You’ve seen what happens when narrative runs ahead of substance. Think Theranos or WeWork - billion-dollar stories built on smoke and mirrors.

For a while, their storytelling was so good that no one asked too many questions about the actual product or economics, and billions went into dreams that couldn’t stand up when the facts came out. These are cautionary tales, reminders that expansion of a weak or unattainable idea is just a recipe for regret.

Then there’s Close.com. They got turned down by YC 7x because they were busy chasing “the right story” for investors. When they finally focused on helping real customers and building solid traction, everything changed.

Facts came first, the story wrote itself, and then Close grew to $50M+/year, because their story compressed genuine value and execution, making what they’d achieved clear and persuasive.

One was storytelling as veneer. The other was storytelling as compression of hard-won insight.

The Day One Problem

Early-stage investing is deciding if the team in front of you can turn the story into value or if it will end as a good story poorly executed.

But what do you do on day one, there’s minimal data to work with. No shortage of “common wisdom” points toward looking at the founders. What are you looking for? How do you measure it?

The excellent Dan Gray frames this well citing a 2021 paper looking at founders as “designers of problems worth solving.” What matters is the relationship between the founders and the problem they’ve chosen to tackle. This way of thinking is outlier-inclusive - it’s not about ticking off credentials or following patterns, but about seeing if the founders genuinely understand and own their problem.

There’s also something to be said for the founder’s ability to sell… not just their fundraising pitch, but their product/ vision/ company.

Markets are reflexive, winners win in part because they position themselves as winners and while maximizing valuation isn’t the whole game, crowning yourself a winner clearly is.

OpenAI epitomizes this power - its story of chasing AGI and democratizing superintelligence has helped drive its valuation to $500 billion, despite operating at eye-watering scale and burn rates. The company is projecting over $12 billion in revenue for 2025, growing rapidly from just $3.7 billion last year.

Yet, the infrastructure behind models like ChatGPT comes with extreme GPU and inference costs, and OpenAI is still running at multi-billion dollar annual losses, prompting skepticism about how much of its valuation is based on future potential versus present economics.

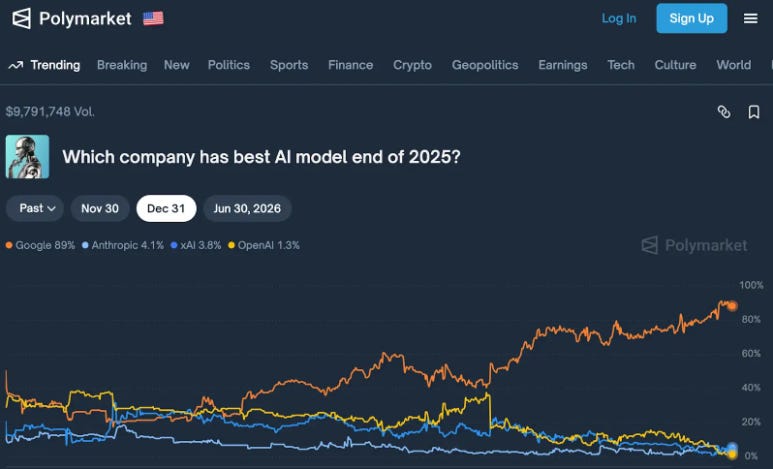

In contrast, Google has struggled to capture the AI story, especially during Bard’s awkward rebrand to Gemini. Despite this, Google is showcasing superior technology and economics on several fronts: its internally developed TPU compute is roughly 80% cheaper than Nvidia GPUs, enabling highly competitive deployment costs (e.g. Gemini 2.5 Flash API at $0.60 per million tokens).

This makes Gemini instantly profitable and allows Google to vertically integrate hardware, software, and cloud R&D - yet they miss out on the “winner” narrative, leading public perception to lag behind actual technical achievement.

Lobster Capital’s Approach (Narrative + Indicators)

We’ve spilled much ink defending high YC valuations. Yes, we’ve invested at high valuations relative to market comps, but this has also unearthed unicorns and high markups in the process.

Ultimately, the market is saying “yes” to these markups because we as buyers believe YC’s “story” - its ability to repeatedly source, select, and supercharge outlier founders.

But we also look at YC’s “facts”, their success rate and their returns rate.

Yes, YC-hype can inflate prices, and for most companies the numbers don’t work out unless they achieve truly exceptional growth and market fit.

But YC success stories are also very real, and while the narrative creates an environment where the rare outliers justify the high entry prices for everyone, if we are consistently getting into the rare outlier deals then we will thrive.

Of course when we look at YC companies, we do care about the story.

But we balance that by going as deep as possible at available indicators behind the story.

Yes, revenue. But revenue is a lagging indicator. But we push to find leading indicators which help forecast future revenue before it appears on the balance sheet. In some scenarios where companies are very early, we can look at things like product iteration volume, but equally pipeline volume, trial signups, user engagement. These tell you something truer about momentum.

Other obvious critical metrics: customer retention, burn rate, cash flow, profitability. For SaaS and subscription businesses, recurring revenue vs churn rate, and customer lifetime value are also better early-stage gauges of traction than revenue alone.

It is then our job to balance the vision of the founder and the reality of their situation to date.

At the earliest stage, when traction data is scarce, backing a compelling team and story can feel like a safer play. But the safer the bet, typically, the lower the returns - so the real challenge is finding those who pair vision with the ability to execute and scale.

Valuation Is Still an Opinion About the Future

In 2018, a typical SF/NY Series A was 8 on 32 post with $500k to $1M of revenue in roughly one to two years.

Today, a typical SF/NY seed is 6 on 30 post with $500k to $1M of revenue in roughly six months.

Most seed investors are momentum Series A investors now. The market moved faster than the frameworks.

This makes the story versus substance distinction even more critical. Less time to prove out the fundamentals means more weight on narrative. More weight on narrative means more opportunity for smoke and mirrors.

Whether you’re investing in public market companies or fast-growing startups, valuation is the rationale by which you determine which opportunities to pursue.

Valuation is not based on verifiable inputs. It’s not provably accurate in output, nor a mirror of market sentiment.

“People act like it’s an award for past behavior. It’s not. It’s a hurdle for future behavior.”

Bill Gurley said that, and I think he’s right.

All investment decisions are bets on today’s fiction. Elon Musk tells you we must get to Mars. Brian Armstrong explains the importance of Bitcoin.

How do you weigh up their past achievements vs. their future visions?

Valuation is the art of using stories to develop opinions about the future. You judge the credibility of a story. You estimate the economic potential. You estimate the risk.

Good stories matter, true. They must be downstream of facts, also true.

The truth can’t get in the way of a good story because the truth is what makes the story good in the first place.

Visit lobstercap.com for more.

Today’s newsletter is brought to you by Stable (YC W20).

Most founders don’t think twice about the address they list when they incorporate — until they realize it’s their home address showing up on public records.

Stable fixes that.

It gives you a real business address you can use everywhere: incorporation, IRS, banks, vendors.

It keeps your personal information private and helps your business look professional from day one.

Every piece of mail that comes to that address, Stable digitizes — with AI summaries that tell you exactly what each item is and what needs your attention, all from one secure dashboard.

Want to never think about address or mail management again? Get an address here

P.S.

Get 50% off a Grow or Scale plan for 3 months with code:LOBSTER50.